This post may contain affiliate links to products or services. I may receive a commission for purchases made through these links with no cost on you. Please read my disclosure for more information.

You may have heard of zero-based budgeting when you started your financial journey because budgeting stands as a cornerstone for achieving financial stability and success.

Among various budgeting methods, zero-based budgeting has emerged as one of the tools for individuals looking to take control of their finances with meticulous planning and allocation.

In this post, we’ll delve into the essence of zero-based budgeting, explore its pros and cons, and provide practical examples to help you implement this strategy effectively.

WHAT IS ZERO-BASED BUDGETING?

Zero-based budgeting (ZBB) is a financial management technique where every dollar of income is assigned a specific purpose, leaving no room for unallocated funds.

Unlike traditional budgeting methods that may leave some money unaccounted for, zero-based budgeting requires a meticulous examination of each expense, ensuring that every dollar has a designated job.

PROS OF ZERO-BASED BUDGETING

Zero-based budgeting (ZBB) enhances financial awareness by requiring active engagement with income and expenses, leading to better decision-making and prudent financial habits.

It prioritizes spending towards essential needs and long-term goals, minimizing wasteful expenditure.

ZBB offers flexibility to adjust spending categories as circumstances change, empowering individuals to adapt their budgets without sacrificing financial stability.

Additionally, ZBB facilitates proactive financial planning, ensuring that every dollar serves a purpose in achieving financial objectives, leading to greater security and preparedness.

CONS OF ZERO-BASED BUDGETING

Zero-based budgeting (ZBB) can be time-consuming due to meticulous planning and expense tracking, especially for those with complex finances.

There’s a risk of oversight as it may miss irregular unexpected expenses, requiring diligence to account for all expenditures.

Adhering strictly to ZBB demands discipline to avoid disrupting financial balance, which can be challenging for individuals prone to impulsive spending or lifestyle inflation.

ZERO-BASED BUDGETING TEMPLATE

If you check out my Etsy shop, you can find my Zero-based Budget template in Excel.

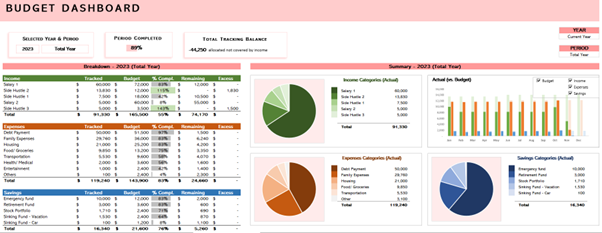

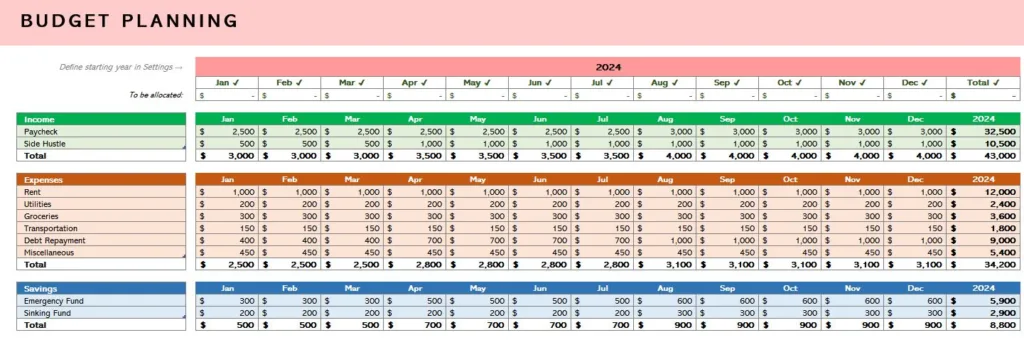

It has 4 Worksheets: the SETTINGS tab, the BUDGET PLANNING tab, the TRANSACTION TRACKER tab, and the BUDGET DASHBOARD tab.

The template is made to be simple, easy to understand, yet visually appealing. All you have to do is input your transactions and everything else is calculated automatically!

Also, it features a:

- 5-year budget plan

- Seven (7) currencies available

- One spreadsheet for multiple budget periods – NO NEED to duplicate tab

- Easily see your finances in charts and tables

- Beginner-friendly

Here’s an example of zero-based budgeting using the Ultimate Zero-based Budget template.

You will see that all income is allocated to the expenses and savings category. The checkmark beside each month is a confirmation that every dollar is assigned.

TIPS FOR SUCCESS

1. Set realistic amounts for each expense / savings category to ensure your budget is sustainable.

2. Allow for flexibility in your budget to accommodate unexpected expenses.

3. Regularly track your expenses to ensure you’re staying within your allocated amounts.

4. Celebrate milestones and achievements as you work towards your financial goals.

Zero-Based Budgeting FAQs

1. How do I handle irregular expenses within a zero-based budget?

Irregular expenses, such as car repairs or medical bills, are inevitable.

To handle them effectively within a zero-based budget, anticipate these costs by analyzing past spending patterns.

Set aside a portion of your income each month into an “irregular expenses” category or sinking fund.

Also, prioritize building an emergency fund to provide a financial cushion for unexpected expenses beyond your regular budget.

2. How do I adjust my zero-based budget when circumstances change?

Adapting your budget to changing circumstances is crucial.

Regularly review your budget to assess progress, reallocate funds as needed, and be proactive in adjusting to changes in income, expenses, or financial goals.

Embrace flexibility and resilience in your approach, understanding that adjustments are essential for staying on track toward your financial objectives.

3. What should I do if my actual spending differs from my planned budget?

In zero-based budgeting, budget variance, the difference between planned and actual spending, is common.

To manage it, analyze the reasons behind the variance, adjust future budgets accordingly, and use it as an opportunity to refine your budgeting strategies for better financial alignment and goal achievement.

4. How can I manage debt repayment within a zero-based budget?

Incorporate debt repayment into your zero-based budget by prioritizing payments towards high-interest debt or following a structured repayment plan.

Ensure a balanced approach by allocating funds for debt payments alongside other financial obligations and savings goals.

Stay committed to your repayment plan, making consistent payments and adjusting your budget as needed to expedite becoming debt-free.

5. How do I balance short-term financial needs and long-term financial goals within a zero-based budget?

To balance short-term needs and long-term goals in a zero-based budget, first, allocate funds for immediate expenses like monthly bills and emergency savings.

Then, prioritize long-term financial aspirations such as retirement or homeownership alongside these short-term necessities.

Regularly review and adjust your budget to ensure both short-term needs and long-term goals are adequately addressed as your financial situation evolves.

6. How can I ensure that I consistently contribute to my savings while meeting my expenses in a zero-based budget?

Prioritize savings by treating it as a non-negotiable expense in your budget.

Allocate a specific portion of your income towards savings each month before allocating funds to expenses.

Automate savings contributions whenever possible to ensure consistency and eliminate the temptation to spend allocated savings elsewhere.

CONCLUSION

Zero-based budgeting is a powerful financial management technique that empowers individuals to take control of their finances, prioritize spending, and proactively plan for the future.

While it requires dedication and discipline to implement effectively, the benefits of enhanced financial awareness, prioritization of spending, and flexibility make it a valuable tool for achieving financial stability and success.

By embracing zero-based budgeting principles and tailoring them to your unique financial situation, you can pave the way toward a brighter financial future.

ACTION PLAN

Share Your Zero-Based Budgeting Journey

We believe that personal finance is not just about numbers; it’s about people and their stories.

We invite you to share your zero-based budgeting journey with our community!

Whether you’re just starting or have years of experience, your insights and stories can inspire others on their financial journey.

Share how you discovered zero-based budgeting, your challenges and triumphs, and any tips you’ve learned along the way. Your contributions will help us all learn and grow together.

To share your story or tips, leave a comment below or reach out via email.

We’ll feature select submissions in future articles, giving you the chance to inspire others and be part of our financial independence community.

Check out other budgeting methods: